Is Financing a Home Project Right for You?

Assess Your Needs

If your water heater is on its last leg, replacing it might be more urgent than upgrading your kitchen faucet. Focus on financing critical repairs first, and save less urgent improvements for later. By prioritizing, you can make sure your financing goes toward what matters most.

Explore All Financing Options

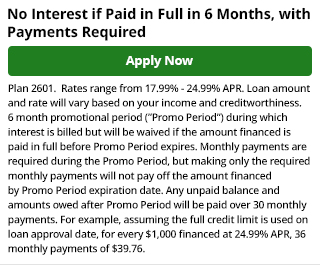

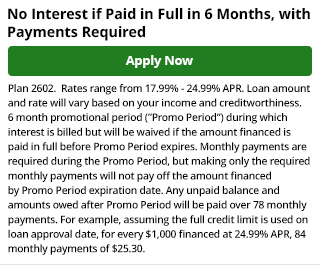

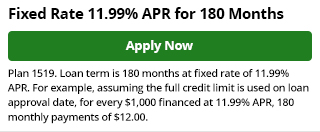

Take the time to compare different financing choices. For instance, can you afford to make all necessary payments on time for a deferred interest plan? If not, you might want to consider a fixed rate loan.

By exploring all options, you can find the best fit for your needs and save money in the long run.

Understand Plan Interest Rates and Terms

Knowing the interest rate and loan terms is crucial. For example, a 0% interest plan might seem attractive, but if it’s only for 12 months and you don’t pay off the balance, higher rates could kick in. Make sure you fully understand what you’re agreeing to so there are no surprises down the road.

Set a Realistic Budget

Figure out what you can comfortably afford each month without overextending yourself. For example, if a new HVAC system costs $5,000, calculate a monthly payment that fits within your budget.

Make sure it doesn’t stretch your finances too thin, so you can manage the payments easily.

Plan for Unexpected Costs

Set aside a little extra in your financing for surprises. For instance, if you’re replacing a furnace, you might discover additional ductwork is needed.

By budgeting for the unexpected, you’ll avoid financial stress if something unexpected comes up.

Want to talk

it out? Give us

a call.

Assess Your Needs

If your water heater is on its last leg, replacing it might be more urgent than upgrading your kitchen faucet. Focus on financing critical repairs first, and save less urgent improvements for later. By prioritizing, you can make sure your financing goes toward what matters most.

Explore All Financing Options

Take the time to compare different financing choices. For instance, can you afford to make all necessary payments on time for a deferred interest plan? If not, you might want to consider a fixed rate loan.

By exploring all options, you can find the best fit for your needs and save money in the long run.

Understand Plan Interest Rates and Terms

Knowing the interest rate and loan terms is crucial. For example, a 0% interest plan might seem attractive, but if it’s only for 12 months and you don’t pay off the balance, higher rates could kick in. Make sure you fully understand what you’re agreeing to so there are no surprises down the road.

Set a Realistic Budget

Figure out what you can comfortably afford each month without overextending yourself. For example, if a new HVAC system costs $5,000, calculate a monthly payment that fits within your budget.

Make sure it doesn’t stretch your finances too thin, so you can manage the payments easily.

Plan for Unexpected Costs

Set aside a little extra in your financing for surprises. For instance, if you’re replacing a furnace, you might discover additional ductwork is needed.

By budgeting for the unexpected, you’ll avoid financial stress if something unexpected comes up.

Want to talk

it out? Give us

a call.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.